Brexit and the implications on exchange rates

Sponsored by Currencies.co.uk

It’s a historic moment that will change the course of history for the people of the UK. For the last 43 years the UK has been a member of the EU which has shaped the way they trade, travel and interact with our neighbour economies. Since last Friday, this is all about to change.

The UK have made the decision to withdraw from the EU, undoing decades of economic, social and political foundations. Today is the first time in history any country might invoke article 50 of the Lisbon treaty, the UK is the first country ever willing to withdraw its membership from the EU.

The UK have made the decision to withdraw from the EU, undoing decades of economic, social and political foundations. Today is the first time in history any country might invoke article 50 of the Lisbon treaty, the UK is the first country ever willing to withdraw its membership from the EU.

David Cameron made his speech on Friday 24th and has announced he will be resigning in October.

With so much uncertainty ahead in terms of how political and economic uncertainties go, how will Sterling cope with such a huge change in direction?

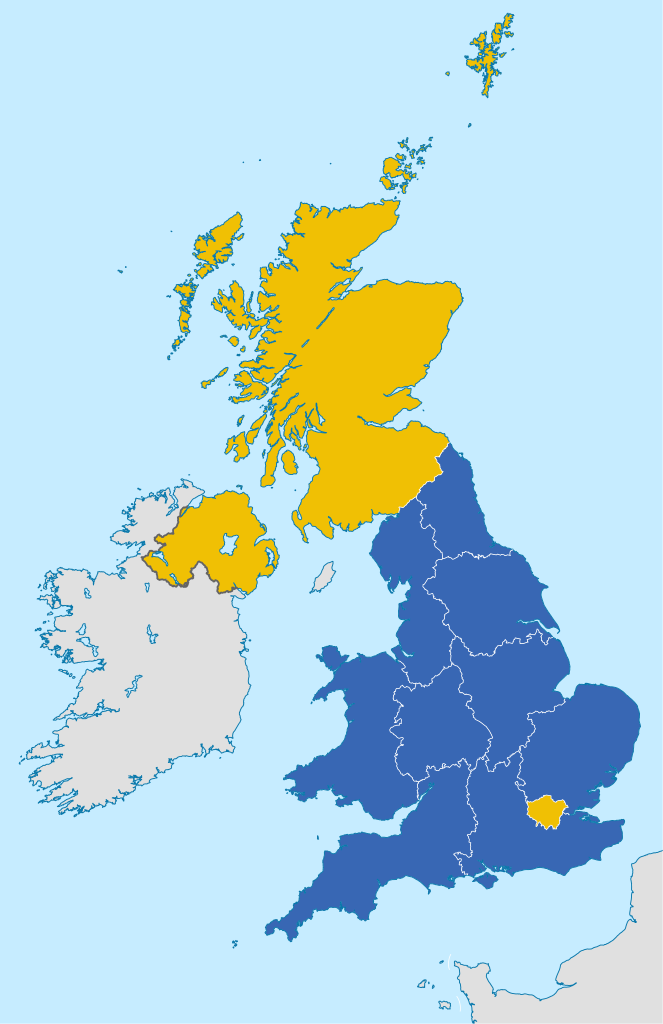

Picture: Result of the referendum by regional voting areas.

Blue= Majority Leave votes;

Yellow= Majority Remain votes.

GBPEUR rates drop sharply as Brexit is announced

As expected, markets reacted to the news which saw Sterling fall to 1.23 against the Euro. As anticipated, investment has shifted to safe-haven currencies such as the US Dollar and Swiss Franc, which may have implications on other economies.

The Euro has also felt the brunt of the results which has seen EURUSD, the worlds most traded currency, fall to 1.10. The implications of a stronger US Dollar on other economies, specifically those that rely on commodity exports is yet to be seen. But given how a large majority of commodities are priced in US Dollars, this will not bode well for economies such as Australia.

The next few months will be a scrutinizing period for the markets and the most agonising aspect of these results is that no one can predict what will happen next.

UK withdrawal from the EU – What happens now?

Under article 50 of the Lisbon treaty, the UK will begin its withdrawal from the EU and has a maximum period of 2 years (that can be extended with agreement from both parties) to do so. During this period, all existing arrangements with the EU continue until the withdrawal process is complete.

The Norway option

What this entails is entirely contingent on what offer the EU provide, and depending on the offer the UK receive could have implications on the Pound.

If the UK were offered EEA membership, similarly to Norway, a large risk sentiment could be reduced for the UK which may be beneficial to the Pound.

This is because the Norway option (EEA option), offers similar arrangements to full EU membership par fishing, agriculture and justice laws. Although unlikely to be welcomed by a portion of the Brexit camp, will still allow for free movement of trade and thus, people. This option could be the easiest, simplest solution but adds little value for the UK. In fact, the UK are no longer able to negotiate laws within the European council and therefore less influence over future agreements.

Never the less, this is considered the better option for the UK and would have the least collateral damage for both Sterling and the Euro. Most of the existing laws would be replicated and investor confidence would rise off the back of an element of certainty. An EEA membership therefore, would have the least implications for the Pound in the mid-term.

What if the UK adapt a Swiss model (EFTA membership)?

The other option that the UK could negotiate is the Swiss model, joining as a member of the EFTA and negotiating bilateral agreements with the EU. This model is likely to have further implications for the Pound longer term, and will likely take more than 2 years to finalise agreements with the other 27 member states.

This longer period of uncertainty will likely put pressure on the Pound and will leave the UK’s economy vulnerable. The EU are under no obligation to extend article 50 past the 2-year period which would leave the UK without any trade deal, forcing them to negotiate terms under the WTO.

The Swiss model would therefore take much longer to negotiate due to the nature of bilateral agreements, and would most likely keep Sterling exchange rates on the lower end of the scale. The main concern here is that the UK has limited say in what deal they can strike with the EU, and could actually be left worse off as a result.

Would the UK be better off under the WTO?

Another option the UK could consider is moving away from EU trade entirely and re-joining as a member of the WTO. This would allow the UK to be freed from the trade barriers set by the EU and would allow the UK to set up trade agreements with non-EU countries.

Although this might appear attractive at first glance, the UK outside of the EU has limited bargaining and buying power and would likely be paying more on imports into the UK. On the other hand, the UK could set their own trade tariffs but would need to be competitive with the EU.

Negotiating terms under the WTO will likely pose the most risk to the UK. Without any EU membership the UK would be less attractive for businesses and investors and could have the most impact on GDP. We therefore hold the view that this scenario would have longer, more serious implications on Pound Sterling and the UK economy as it poses the most uncertainty.Will Pound Sterling recover long term?

It’s difficult to predict what will happen given that no strategic plan was suggested in the event of a Brexit. Sterling has the potential to recover long term once new trade agreements materialise, but there are other factors that need to be considered.

What will happen to public spending as a result of a Brexit? What will happen to consumer prices and foreign investment? How will all of this impact economic releases going forward?

It’s not implausible to conceive that the UK may be hit by another recession and Mark Carney of the BoE has issued stern warnings surrounding this argument. In the event UK inflation fell the BoE may be forced to lower Interest rates, all of which would have negative implications for Sterling.

Conclusion

With so much uncertainty in the pipeline and little strategic efforts in place to limit the potential economic damage of this week’s results, it’s difficult to predict what will happen next for the UK. It will need to act fast to ease the anxiety felt by many businesses and investors as they are left in limbo over the future of the UK.

In the short term, Sterling will likely remain in the lower 1.20’s until trade deals start to form and confidence in the economy is restored. Pay close attention to economic releases over the course of the year and into 2017, these will be key indicators of the UK’s outlook.

There is of course, an opportunity for those selling Euro’s for Pound’s and those looking to move back to the UK will find the Pound noticeably cheaper.

Credit:

Jonathan Watson

Chief Market Analyst

Currencies.co.uk

Discussions in our forum >> Brexit: What do you think?

The content of this post has been sponsored. "Sponsored" posts are not editorial articles. They are provided by or written for an advertiser who validates the content.